Getting your mortgage approved in Canada is a rigorous process governed by strict federal regulations. Even when you are making a sufficient income, you need to demonstrate strong financial health, disciplined credit behaviour and clean documentation.

Current mortgage rates in Canada, lender risk policies, and other factors are constantly evolving, making comprehensive preparation essential to succeed.

The Office of the Superintendent of Financial Institutions (OSFI) and other federal bodies shape the mortgage ecosystem. Similarly, mortgage insurers such as CMHC define critical debt service limits.

This article shares a checklist outlining 20 steps to help you meet the strictest qualifications for mortgage approval.

1. Achieve and Maintain a Target Credit Score

Lenders check your credit score to assess your reliability and financial character.

Major Canadian banks require a minimum credit score of 680 for uninsured mortgages.

An uninsured mortgage does not require mortgage default insurance as the borrower makes a down payment of 20% or more. |

The Canada Mortgage and Housing Corporation (CMHC) may insure your mortgage for a credit score as low as 600. Still, 680+ helps you secure competitive mortgage rates in BC, Canada.

A credit score between 760 and 900 helps you secure the best mortgage interest rate in Canada.

2. Optimize Your Credit Utilization Ratio

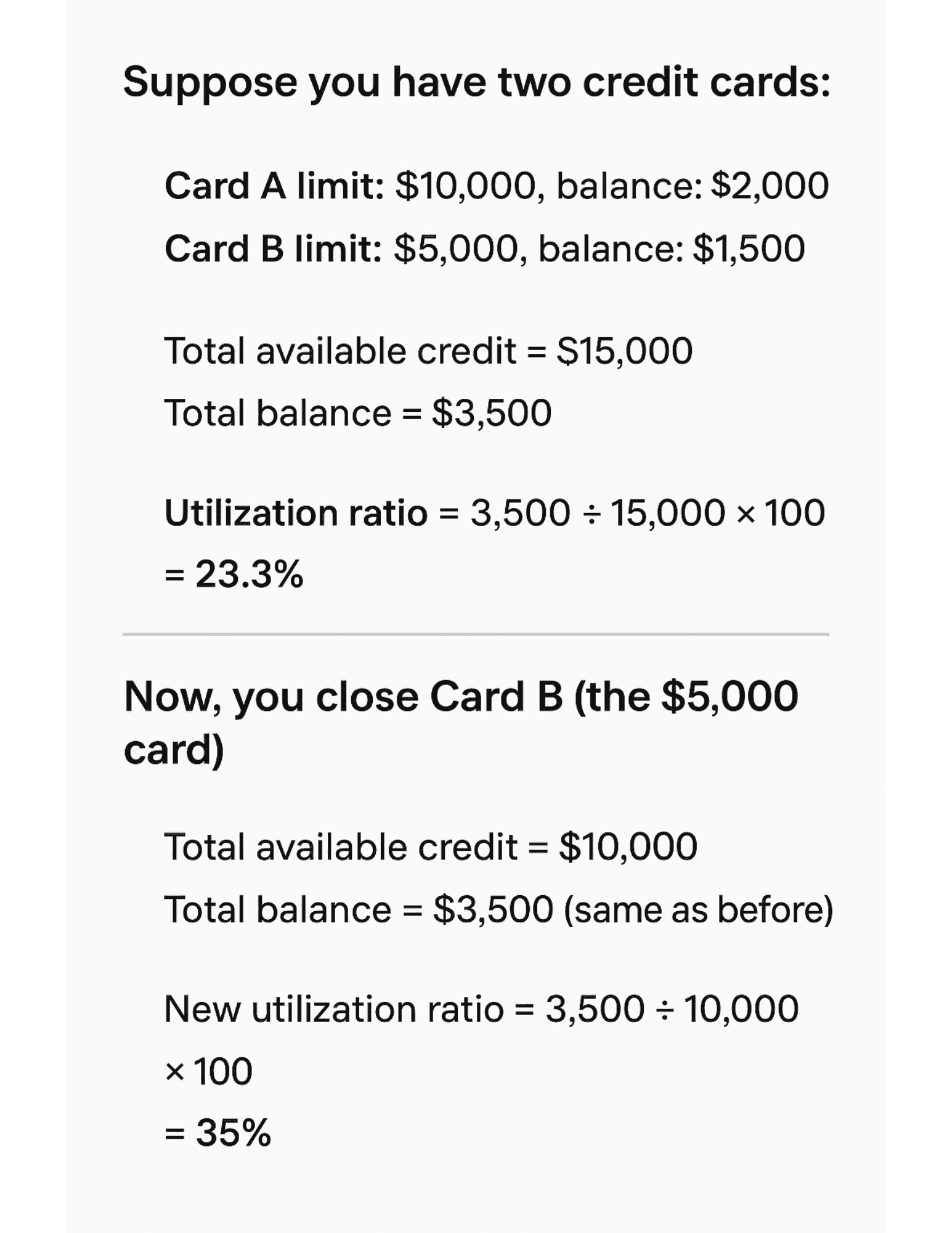

Your credit utilization ratio indicates your financial dependence on borrowed money. Keep your credit utilization ratio below 30%. For example, if you have a credit limit of $10,000, your balance should remain under $3,000.

Keep in mind that closing established cards can reduce the total available credit and increase your credit utilization ratio.

3. Freeze All Applications for New Credit

Mortgage underwriting requires a snapshot of your financial stability. Applications for new credit cards, personal loans, or even certain service contracts trigger a hard inquiry on your credit file, which temporarily reduces your credit score. This may indicate that you are experiencing financial strain.

4. Audit and Dispute Any Credit Report Errors Immediately

Incorrect payment status, fraudulent accounts and other errors can lower your credit score. Get your credit reports from TransUnion and Equifax well in advance of applying. Immediately dispute whenever you discover any error. It can take weeks or even months to make corrections.

5. Calculate and Clear Debt to Meet TDS/GDS Ratios

Federal regulations have made meeting the Debt Service Ratios mandatory under the qualification pressure of the mortgage stress test. Lenders rely on the following two ratios to determine if you can afford it or not:

Gross Debt Service (GDS) Ratio

Total Debt Service (TDS) Ratio

Ratio | Description | Description Maximum % (CMHC Standard) | Inclusion Criteria |

|---|---|---|---|

Gross Debt Service (GDS) | Monthly housing costs vs. Gross monthly income | 39% | Principal, Interest, Property Taxes, Heating Costs, 50% of Condo Fees |

Total Debt Service (TDS) | Total monthly debt vs. Gross monthly income | 44% | GDS + All other monthly debt payments (loans, credit cards, student loans, support payments) |

6. Avoid Closing Established, Paid-Off Credit Lines

Your credit history is based on the average age of all active credit accounts, including mortgages, loans, and credit cards. A longer credit history demonstrates reliability and consistent debt repayment habits.

When you close a credit card that has been open for a long time, it immediately shortens your credit history. This also negatively impacts your credit score. Even if you have paid off an old account, keep it open and active.

7. Obtain a Meticulous Letter of Employment (LoE)

The Letter of Employment (LoE) serves as proof of your current professional status and guaranteed earnings. The LoE must be submitted within 30 days of the mortgage application. This document must explicitly state:

Guaranteed annual salary or hourly wage

Formal position and job title

Start date

Confirmation of employment type (full-time, permanent, and guaranteed)

8. Document Two Years of Consistent Variable Income

Non-guaranteed incomes, such as commissions, bonuses, or overtime, are subject to increased scrutiny. You need to demonstrate a substantial history of these earnings for lenders to consider them in the affordability calculation.

Lenders typically require the last two years of Notice of Assessments (NOAs) and T4 (Statement of Remuneration Paid) slips to assess stability.

9. Prove Business Longevity and Tax Compliance (for self-employed)

Sole proprietors, partners, incorporated business owners and other self-employed applicants often strategically minimize their taxable income. As a result, their qualifying income is often much lower than their business’s actual cash flow.

Self-employed applicants are required to produce the following two documents:

Two years of accountant-prepared financial statements (T2s for corporations) and corresponding Notices of Assessment (NOAs)

Two years of T1 Generals, including the Statement of Business Activities (for sole proprietors)

Lenders’ assessment is based on taxable income, specifically the amount you reported on Line 150(00) of the NOA.

Lenders also require:

Three months of both personal and business bank statements

A business license or registration

Proof of business stability through invoices and an ongoing contract

If your documented self-employment history is shorter than two years, prime lenders will not support your application. You will have to rely on alternative lenders, incurring higher interest rates.

10. Ensure Zero Tax Arrears with the CRA

Lenders use the Notices of Assessment (NOAs) to verify your income and confirm that you have no outstanding tax liability to the Canada Revenue Agency (CRA). The lender will require proof that all prior taxes have been paid before approving a loan.

Unpaid statutory obligations indicate that you may prioritize unsecured operating costs over government debts, suggesting a higher risk of prioritizing other expenses over future mortgage payments.

Always pay off your outstanding tax arrears in full and obtain an Account Status or Clearance Letter from the CRA.

11. Maintain Stable Employment During the Process

Lenders rely on the predictability of your income to evaluate if you can afford a mortgage. Make sure that you don’t change jobs from the time of application to the final closing date.

In case a job change is unavoidable, provide a new Letter of Employment to your mortgage professional. They may have to re-evaluate your income.

12. Determine the Minimum Down Payment and Insurance Requirement

The minimum down payment requirements depend on the purchase price of the property.

Price Range | Minimum Down Payment Required |

|---|---|

$500,000 or less | 5% of the purchase price |

Between $500,000 and $1.5 million | 5% of the first $500,000 + 10% of the portion above $500,000 |

$1.5 million or more | 20% of the purchase price |

If the down payment is less than 20% of the purchase price, then you must obtain mandatory mortgage loan insurance (provided by CMHC, Sagen, or Canada Guaranty).

13. Document the 90-Day History for All Down Payment Funds (AML Compliance)

Many borrowers often fail to prepare for the 90-day rule, a key part of anti-money laundering (AML) checks in mortgage applications. Lenders are required to show that your down payment had been in your account for at least 90 days before you applied.

14. Justify All Large Deposits

Any unexplained large deposit in your bank statement within those 90 days triggers inquiries from the underwriter. Lenders generally define a "large deposit" as $1,000 or more. You must justify the large deposit.

15. Formalize Gifted Funds with a Signed Gift Letter

You are allowed to use gifted down payments from family members. However, the process is highly regulated to ensure that it is a genuine gift. Prime lenders accept gifted funds only from immediate family members, including parents, grandparents, or siblings (next of kin).

All mortgage insurers (CMHC, Sagen, and Canada Guaranty) require a signed gift letter stating that you don’t have to repay the gift. The letter must also include the donor's name, the donor's relationship to the borrower, and the donor's contact information.

16. Secure a Verified Mortgage Pre-Approval Certificate

Mortgage pre-approval provides you with the following advantages:

It shows how much you can afford

It locks in an interest rate for a set period

Pre-approval includes a credit check and a detailed review of your income and documents. Having this certificate demonstrates to real estate agents and sellers that you have a verified budget.

17. Stress Test Your Affordability Using the MQR Formula

OSFI’s Guideline B-20 requires lenders to make sure that you can afford their mortgage at a higher interest rate (Minimum Qualifying Rate). The MQR is the higher of 5.25% or the actual mortgage rate + 2%.

For example, you must qualify at 6.0% if your lender is offering you a mortgage rate of 4%.

Lenders rely on this higher rate to ensure your payments fit within the GDS and TDS ratios.

18. Choose Your Financing Partner

Whether you should opt for a bank mortgage specialist or an independent broker depends on financial complexity. Banks have strict criteria and offer their own products. On the other hand, brokers can access multiple lenders and help you secure better rates.

Brokers provide the options and flexibility required for self-employment income, unconventional down payments, lower credit scores and other complex files.

19. Immediately Cease All Major Spending and New Loans

Once you have received mortgage pre-approval, make sure your finances remain unchanged until closing. Lenders’ commitment is based on your financial profile at the time of pre-approval.

Avoid taking on new debts. Even if you can afford new obligations, your increased monthly payments are considered in the TDS ratio.

As the MQR stress test already stresses the TDS ratio, new debts can exceed the 44% maximum. When the lender performs a final credit check before closing, new liabilities can reduce or cancel your approval.

20. Prepare for Property Appraisal and Mandatory Home Insurance

Finally, the lender verifies that the property meets their collateral requirements. They assess the value of the property and ensure proper insurance coverage. Lenders order a required property appraisal. You must provide accurate property details, including planned improvements. Also, provide proof of homeowner’s insurance coverage.

Conclusion

Getting your mortgage approved at competitive mortgage rates in Canada requires disciplined financial habits and thorough documentation. This checklist can help you maximize your chances of approval. Stay organized, maintain financial stability and meet all the key lender requirements.